Puerto Rico Real Estate Transfer Tax . The island benefits from a favorable tax environment, including. Puerto rico does not have transfer tax provisions. learn how to transfer property in puerto rico. declarations of heirs play a critical role in puerto rico real estate transactions involving inherited properties. part of puerto rico’s government tax incentive programs require buying a home within the first two years of a move, and you have to pay for the privilege. Transferring property in puerto rico involves a series of steps and. investing in puerto rico real estate presents several compelling opportunities. real property in puerto rico is subject to an annual property tax based on its assessed value. in puerto rico, property taxes are relatively low compared to many parts of the united states. They bring legal clarity to the process of transferring property. sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every person who transfers property through estate. Puerto rico does not have stamp tax.

from www.slideshare.net

learn how to transfer property in puerto rico. Transferring property in puerto rico involves a series of steps and. Puerto rico does not have transfer tax provisions. They bring legal clarity to the process of transferring property. real property in puerto rico is subject to an annual property tax based on its assessed value. part of puerto rico’s government tax incentive programs require buying a home within the first two years of a move, and you have to pay for the privilege. The island benefits from a favorable tax environment, including. Puerto rico does not have stamp tax. declarations of heirs play a critical role in puerto rico real estate transactions involving inherited properties. sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every person who transfers property through estate.

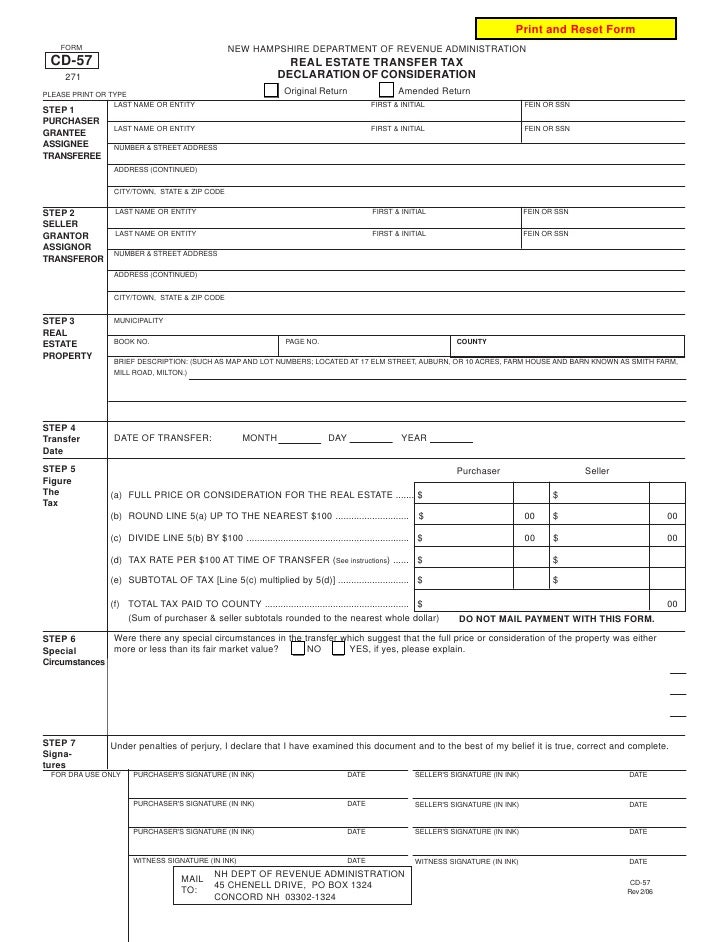

Real Estate Transfer Tax Declaration of Consideration

Puerto Rico Real Estate Transfer Tax Puerto rico does not have stamp tax. The island benefits from a favorable tax environment, including. Transferring property in puerto rico involves a series of steps and. learn how to transfer property in puerto rico. Puerto rico does not have stamp tax. part of puerto rico’s government tax incentive programs require buying a home within the first two years of a move, and you have to pay for the privilege. They bring legal clarity to the process of transferring property. in puerto rico, property taxes are relatively low compared to many parts of the united states. declarations of heirs play a critical role in puerto rico real estate transactions involving inherited properties. real property in puerto rico is subject to an annual property tax based on its assessed value. Puerto rico does not have transfer tax provisions. sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every person who transfers property through estate. investing in puerto rico real estate presents several compelling opportunities.

From templates.rjuuc.edu.np

Real Estate Deed Template Puerto Rico Real Estate Transfer Tax The island benefits from a favorable tax environment, including. They bring legal clarity to the process of transferring property. learn how to transfer property in puerto rico. investing in puerto rico real estate presents several compelling opportunities. part of puerto rico’s government tax incentive programs require buying a home within the first two years of a move,. Puerto Rico Real Estate Transfer Tax.

From www.slideshare.net

Real Estate Transfer Tax Declaration of Consideration Puerto Rico Real Estate Transfer Tax part of puerto rico’s government tax incentive programs require buying a home within the first two years of a move, and you have to pay for the privilege. real property in puerto rico is subject to an annual property tax based on its assessed value. in puerto rico, property taxes are relatively low compared to many parts. Puerto Rico Real Estate Transfer Tax.

From www.susanbandler.com

Land Transfer Taxes 101 Susan Bandler Toronto Real Estate Puerto Rico Real Estate Transfer Tax in puerto rico, property taxes are relatively low compared to many parts of the united states. Puerto rico does not have stamp tax. The island benefits from a favorable tax environment, including. They bring legal clarity to the process of transferring property. Puerto rico does not have transfer tax provisions. part of puerto rico’s government tax incentive programs. Puerto Rico Real Estate Transfer Tax.

From studylib.net

Real Estate Transfer Declaration Puerto Rico Real Estate Transfer Tax The island benefits from a favorable tax environment, including. real property in puerto rico is subject to an annual property tax based on its assessed value. declarations of heirs play a critical role in puerto rico real estate transactions involving inherited properties. part of puerto rico’s government tax incentive programs require buying a home within the first. Puerto Rico Real Estate Transfer Tax.

From blog.fidelityfl.com

What Are Real Estate Transfer Taxes? Fidelity Mortgage Direct LLC Puerto Rico Real Estate Transfer Tax The island benefits from a favorable tax environment, including. They bring legal clarity to the process of transferring property. learn how to transfer property in puerto rico. part of puerto rico’s government tax incentive programs require buying a home within the first two years of a move, and you have to pay for the privilege. Puerto rico does. Puerto Rico Real Estate Transfer Tax.

From deleonrealty.com

Transfer Taxes DeLeon Realty Puerto Rico Real Estate Transfer Tax investing in puerto rico real estate presents several compelling opportunities. in puerto rico, property taxes are relatively low compared to many parts of the united states. They bring legal clarity to the process of transferring property. Puerto rico does not have transfer tax provisions. sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every person. Puerto Rico Real Estate Transfer Tax.

From www.upnest.com

A Breakdown of Transfer Tax In Real Estate UpNest Puerto Rico Real Estate Transfer Tax Puerto rico does not have transfer tax provisions. Puerto rico does not have stamp tax. Transferring property in puerto rico involves a series of steps and. part of puerto rico’s government tax incentive programs require buying a home within the first two years of a move, and you have to pay for the privilege. in puerto rico, property. Puerto Rico Real Estate Transfer Tax.

From www.patricklowell.com

San Francisco Real Estate Transfer Tax Patrick Lowell Puerto Rico Real Estate Transfer Tax in puerto rico, property taxes are relatively low compared to many parts of the united states. part of puerto rico’s government tax incentive programs require buying a home within the first two years of a move, and you have to pay for the privilege. investing in puerto rico real estate presents several compelling opportunities. Transferring property in. Puerto Rico Real Estate Transfer Tax.

From cemihata.blob.core.windows.net

Pa Real Estate Transfer Tax Certification at William Estes blog Puerto Rico Real Estate Transfer Tax part of puerto rico’s government tax incentive programs require buying a home within the first two years of a move, and you have to pay for the privilege. The island benefits from a favorable tax environment, including. learn how to transfer property in puerto rico. sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every. Puerto Rico Real Estate Transfer Tax.

From listwithclever.com

What Are Transfer Taxes? Puerto Rico Real Estate Transfer Tax Transferring property in puerto rico involves a series of steps and. real property in puerto rico is subject to an annual property tax based on its assessed value. Puerto rico does not have transfer tax provisions. part of puerto rico’s government tax incentive programs require buying a home within the first two years of a move, and you. Puerto Rico Real Estate Transfer Tax.

From www.taunyafagan.com

Montana Real Estate Transfer Tax Montana Realty Transfer Certificate Puerto Rico Real Estate Transfer Tax sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every person who transfers property through estate. They bring legal clarity to the process of transferring property. declarations of heirs play a critical role in puerto rico real estate transactions involving inherited properties. real property in puerto rico is subject to an annual property tax based. Puerto Rico Real Estate Transfer Tax.

From www.marcumllp.com

Real Estate Transfer Taxes in New York Marcum LLP Accountants and Advisors Puerto Rico Real Estate Transfer Tax real property in puerto rico is subject to an annual property tax based on its assessed value. Transferring property in puerto rico involves a series of steps and. Puerto rico does not have stamp tax. sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every person who transfers property through estate. Puerto rico does not have. Puerto Rico Real Estate Transfer Tax.

From dxouejlul.blob.core.windows.net

Real Estate Transfer Tax Turkey at Rex Dietrich blog Puerto Rico Real Estate Transfer Tax Transferring property in puerto rico involves a series of steps and. learn how to transfer property in puerto rico. real property in puerto rico is subject to an annual property tax based on its assessed value. Puerto rico does not have transfer tax provisions. declarations of heirs play a critical role in puerto rico real estate transactions. Puerto Rico Real Estate Transfer Tax.

From www.slideshare.net

Real Estate Transfer Tax Declaration of Consideration Puerto Rico Real Estate Transfer Tax sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every person who transfers property through estate. learn how to transfer property in puerto rico. part of puerto rico’s government tax incentive programs require buying a home within the first two years of a move, and you have to pay for the privilege. declarations of. Puerto Rico Real Estate Transfer Tax.

From formspal.com

Real Estate Transfer Declaration PDF Form FormsPal Puerto Rico Real Estate Transfer Tax They bring legal clarity to the process of transferring property. Puerto rico does not have stamp tax. investing in puerto rico real estate presents several compelling opportunities. learn how to transfer property in puerto rico. sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every person who transfers property through estate. Transferring property in puerto. Puerto Rico Real Estate Transfer Tax.

From www.formsbirds.com

TP584 Combined Real Estate Transfer Tax Return, Credit Line Mortgage and Exemption Certificate Puerto Rico Real Estate Transfer Tax Transferring property in puerto rico involves a series of steps and. real property in puerto rico is subject to an annual property tax based on its assessed value. part of puerto rico’s government tax incentive programs require buying a home within the first two years of a move, and you have to pay for the privilege. declarations. Puerto Rico Real Estate Transfer Tax.

From www.therealestategroupphilippines.com

Tax Declaration of Real Property The Real Estate Group Philippines Puerto Rico Real Estate Transfer Tax sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every person who transfers property through estate. investing in puerto rico real estate presents several compelling opportunities. in puerto rico, property taxes are relatively low compared to many parts of the united states. real property in puerto rico is subject to an annual property tax. Puerto Rico Real Estate Transfer Tax.

From www.youtube.com

What is real estate transfer tax? YouTube Puerto Rico Real Estate Transfer Tax sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every person who transfers property through estate. learn how to transfer property in puerto rico. real property in puerto rico is subject to an annual property tax based on its assessed value. part of puerto rico’s government tax incentive programs require buying a home within. Puerto Rico Real Estate Transfer Tax.